Ethereum is a blockchain-based system where anyone can build and securely deploy any digital service without going through a formal, centralised approval process – such as getting an App added to Apple’s App Store. Ethereum is a boon for the banking and finance industry, with the innovation of decentralized finance or DeFi Apps. DeFiapps are based on Ethereum’s distributed ledger, which makes it challenging for hackers to steal or tamper with the data of consumers.

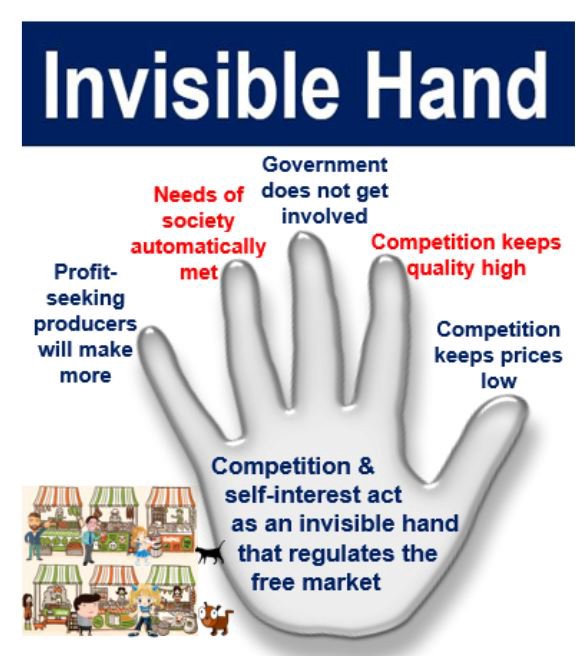

As a result, it has become known as the predecessor to virtually all cryptocurrencies that have emerged over the past decade. It’s distributed in the sense that everyone participating in the Ethereum network holds an identical copy of this ledger, letting them see all past transactions. It’s decentralized in that the network isn’t operated or managed by any centralized entity—instead, it’s managed by all of the distributed ledger holders. Whether Ethereum is a healthy part of your investment portfolio depends on several factors. First, you need to make sure you completely understand what you are investing in and how it works.

Proof-of-stake blockchains do not require mining; instead, they use a process called staking, which incentivizes people to put cryptocurrency at stake to vouch for the accuracy of transactions. Participating users get rewards akin to interest in a bank account when the system works normally. The founder’s vision was to create a decentralized platform for executing smart contracts and building decentralized applications beyond just trading cryptocurrencies. So, any transaction or action happening on a Twitter-type application that has now been transformed will be a decentralized transaction. A reusable snippet of code (a program) which a developer publishes into EVM state.

- Also, currently, its crypto, ETH, accounts for around 17% of the total market cap.

- This idea is similar to cloud computing, where many computers handle the workload to reduce computational time.

- Now you need to hold a certain number of ETH in order to become a validator and earn rewards of new ETHs, which is quite challenging.

- Head over to our “Ethereum Explained” Ethereum tutorial video to see an in-depth demo on how to deploy an Ethereum smart contract locally, including installing Ganache and Node in a Windows environment.

- In proof of stake, the miner—who is the validator—can validate the transactions based on the number of crypto coins he or she holds before actually starting the mining.

You will simply need to connect an existing bank account to cash out the sale. The agreement is coded into the Ethereum blockchain, and the contract https://www.xcritical.in/ self-executes when those conditions are met. I thought [people in the Bitcoin community] weren’t approaching the problem in the right way.

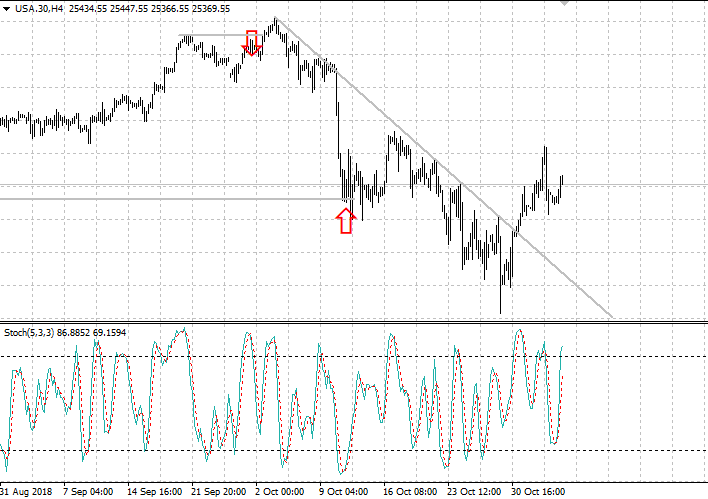

Sharding is a computer science technique used to distribute the load on a particular network. In Ethereum’s case, the idea is to spread the transactional and contractional data processing load across 64 different chains. It is hoped that this technique will improve Ethereum’s capacity to process transactions to up to 100,000 per second. By providing a blockchain complete with a programming language, Ethereum can achieve its objective of being a platform for decentralised, reliably secure and universally accessible apps to be built on. Users pay ETH to other users to have their code execution requests fulfilled.

Anyone who wants to add new blocks to the chain must stake ETH – the native currency in Ethereum – as collateral and run validator software. These „validators” can then be randomly selected to propose blocks that other validators check and add to the blockchain. There is a system of rewards and penalties that strongly incentivize participants to be honest and available online as much as possible. The main difference between Bitcoin and Ethereum is that while Bitcoin is a payment token, Ethereum, in addition to facilitating payments, enables the blockchain network to build an array of applications. Bitcoin has a lifetime cap of 21 million, while for ETH, there is no such cap (only an annual cap of 18 million.) Thus, both derive their value differently.

In addition, digital assets like Non-fungible Tokens (NFTs) also use the Ethereum blockchain network, broadening its use case in the digital assets industry. Ethereum is a Blockchain network that introduced a built-in Turing-complete programming language that can be used for creating various decentralized applications(also called Dapps). The Ethereum network is fueled by its own cryptocurrency called ‘ether’.

How far could Ethereum have taken you?

If it’s not a time-sensitive transaction, you can sometimes save money by waiting for fees to go down. They are both cryptocurrencies, and together, they make up more than half of the overall crypto market. The main difference between Bitcoin and Ethereum is that Bitcoin was designed as a way to carry out relatively simple digital payments.

The main goal of this phase was to monitor the validators that were accountable for generating blocks within the Eth 2.0 blockchain. Additionally, this phase laid the groundwork for the upcoming phases in the development of the network. A sidechain is like a separate blockchain looking at the Ethereum Mainnet through a two-way bridge. What makes it efficient is that it has its own rules and faster transaction processing.

Ethereum is a network of computers all over the world that follow a set of rules called the Ethereum protocol. The Ethereum network acts as the foundation for communities, applications, organizations and digital assets that anyone can build and use. As of Aug. 13, 2023, Bitcoin had a market cap of $571 billion, accounting for about 48.8% of the total cryptocurrency market, which was valued at just over 1.17 trillion. Ethereum, with a market cap of $221.6 billion, had a market share of just short of 19%. Ethereum will also introduce sharding sometime in 2023 to enhance its scalability.

The Prime Components Of Ethereum

Its primary goal is to establish a connection between Ethereum 1.0 and Ethereum 2.0 through a process called ‘Docking’. The Beacon Chain introduced Proof-Of-Stake to the Ethereum network, and it was integrated into the PoS network within the older version of the Ethereum blockchain (Eth https://www.xcritical.in/blog/ethereum-vs-bitcoin-the-two-cryptocurrencies-compared/ 1). In simple terms, forks are updates made to a cryptocurrency’s protocol. State channels let people transact securely off-chain with minimal interaction on Ethereum Mainnet. Users can do many off-chain transactions and only need two on-chain transactions to open and close the channel.

What is Ethereum’s purpose?

We just discussed how miners add a transaction to the Ethereum blockchain using Proof-of-Work. Ethereum and stablecoins simplify the process of sending money overseas. It often takes only few minutes to move funds across the globe, as opposed to the several business days or even weeks that it may take your average bank, and for a fraction of the price. Additionally, there is no extra fee for making a high value transaction, and there are zero restrictions on where or why you are sending your money.

This limitation of Ethereum, coupled with its ability to empower developers to produce DApps, led to the rise of the ICO ecosystem. An ICO – initial coin offering – initially funded Ethereum; inspiring many developers to raise funds similarly. It lasted around 6 months in 2016 before an attack that saw nearly $50 million worth of Ether stolen.