Contents:

Where the Accrual vs Deferral starts and ends, who does what step in the process and the desired results included. You’ll also want to explain why the process is important to your company . Looking at the process , assign out who will be the process owner, key stakeholders, and the outside opinion. And just give them a heads up on what’s happening and what will eventually be expected of them. An outside opinion refers to anyone who is not immediately or directly impacted by the process. They’ll be asked to review the final documentation and offer any feedback.

Take the list you’ve come up with and organize the steps sequentially. You’ll be able to build business process flows that work out for you. If only NASA had documented checks and validation procedures, the disaster could have been avoided.

- It helps you form a process for creating the process documentation and ensure that every user knows their place in the production line.

- Whatfix lets you create step-by-step walkthroughs, in-app prompts, task lists, videos, and self-help widgets to teach users how to use new software.

- You need to already know how the process works before you can actually improve it and create the to-be business process document.

- Ideally, your company should employ professional technical writers who have experience in preparing documentation.

This will give you the chance to identify which process steps can be simplified or eliminated altogether. An updated SOP will allow your team to function more effectively and efficiently. In this article, we will be discussing the benefits of process documentation as well as how to document a process in your business efficiently and effectively. Your work is done for now, but that doesn’t mean your process documentation is set in stone.

Review and Evaluate

Chances are good that some process owners will own multiple processes. Such that the person who owns hiring will likely also own your offboarding process. Just make sure the person knows all the processes that they own. For example, although everyone on your People Ops team might be involved in your hiring process, only the department head will document how you hire. In these cases, you’ll need to appoint one process owner to own the documentation. So, we like to choose the person with the most experience running it or the contributor who runs it best.

The Constitution Is a Plutocratic Document – Jacobin magazine

The Constitution Is a Plutocratic Document.

Posted: Sat, 22 Apr 2023 14:48:52 GMT [source]

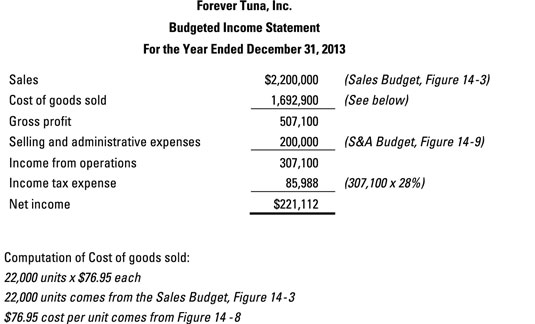

Or we could create a flow chart showing where each piece of information comes from. Call out who is responsible for and involved in each step. The matrix shows each step and shows every role involved. It lists who’s responsible, who’s accountable, and who needs to be consulted or informed. If you’ve ever tried to use a new application following only written instructions, you know that a picture is worth a thousand words. Documentation with images and videos makes tutorials easier to follow.

Document Management Software

Start by identifying and naming the process or workflow you want to document. Describe why the process documentation is important, how it benefits your company and what will be included. The last step in process documentation is to collect all the bits and pieces, charts and maps, and feedback and suggestions. Put them together to design training manuals, reference guides or whatever else you want. This is the step where your documentation starts taking its initial shape.

That’s why process documentation – recording, in detailed steps, how those processes happen – is so important. When your team gets better at your commonly repeated tasks, everyone is more productive overall. Far from restricting your employees and stifling creativity, process documentation gives them the tools they need to do their jobs effectively. It frees up time for employees to focus on more meaningful work and ensures you can operate better as a company. Digital Adoption Platforms like Whatfix can help you with your process documentation. Whatfix eliminates the walls between your users and true productivity across all software.

But how can you ensure steps don’t fall through the cracks? The secret to effective process documentation is, well, in the process. Process documentation keeps your team in the loop with instructions on how to perform specific tasks or projects.

Process documentation like you’ve never seen before!

And it’s an essential part of successful project management. Process documentation is the action of listing each step, participant, and item required to complete a task. You’ll most often document the workflow for repetitive tasks so anyone can follow “the recipe” and achieve the same outcome. The same holds true for any process in your organization. When you document and share institutional knowledge, the outcomes are more consistent.

How to get a ‚cita previa’ (appointment) in Spain when it seems … – The Local Spain

How to get a ‚cita previa’ (appointment) in Spain when it seems ….

Posted: Mon, 24 Apr 2023 08:34:35 GMT [source]

Therefore, business processes should be transparent, agile, and efficient. Unfortunately, many team members develop business processes without a thoughtful determination of how each process fits into the business’s overall structure. When creating process documentation, there’s a risk that your documents will end up stuck in a silo. However, by choosing the right tools, you can reduce risks and ensure that documentation is more widely used. Your business process documentation is the lifeline of your operations.

Customizable Process Documentation Templates

Not everything in life is as simple as following directions. Context is essential for successfully executing many business processes. Your process documentation may require additional content to describe possible variations based on different business needs and goals. You can organize and distribute this process input worksheet in a survey collection tool like Google Forms. Examples of knowledge management software include Helpjuice, Confluence, and Notion. Process documentation is the act of capturing or documenting all of the steps in a particular task.

This is especially important as employees enter or leave the organisation. Whatfix lets you create step-by-step walkthroughs, in-app prompts, task lists, videos, and self-help widgets to teach users how to use new software. Tettra allows you to add “Verified by” tags to your knowledge base, collect content requests from your team, and identify content that needs a refresh. A collaborative documentation tool makes it easy for all stakeholders to contribute ideas, suggest changes, and even edit the document if needed. Create your process document by taking your outline and adding detailed instructions for each step.

This is why it’s important to create a knowledge transfer plan and establish a system for employees to share their knowledge. In frevvo, you can add a conditional rule that routes invoices above a certain value to a CFO for review before issuing payment. It’s a seemingly small change, but it’s one that canimprove your processesand your bottom line. Now that you listed out the process activities for each step, the next step is to put them in the correct sequence to create your workflow. Follow these steps to document a process and identify areas of improvement. These processes typically follow the same steps as they move from one step to the next.

- Such a system allows only authorized individuals to access your documentation, thus preventing any unwanted activities.

- A business process may not always follow the same flow due to various reasons.

- When you understand every aspect of a process, you can protect data and physical resources better.

- Take advantage of diverse media sources and documentation tools to ensure processes are as clear, accurate, and complete as possible.

- Documenting different processes, especially complex ones, takes time and resources.

But if you’re running a professional bakery, your customers expect consistent quality and flavor. So you write down a recipe with a list of ingredients and step-by-step instructions. That way, even a new employee can recreate your world-famous fudge swirl masterpiece. To help new, aspiring and seasoned business analyst from across the world who want to either start or further their careers. We guide and support them on their personal journeys so that each one of them reaches their full potential in the ever-changing business analysis profession. Gather everyone involved and review the business process.

Tweaking the systems and rolling out a new version of the documents becomes a piece of cake. A well-defined foundation enables stakeholders and leadership to quickly grasp the nature and significance of the process. Simplified User Interface graphics are great for this application as well. They allow you to avoid frequent updates to your content, such as cases when buttons move around in software applications. For example, try not to use version numbers in software, dates, or references that could quickly become irrelevant. Being mindful of your approach can help you keep your content up-to-date longer.

Xceptor: Solving the Challenge of Bringing Automation into … – The Fintech Times

Xceptor: Solving the Challenge of Bringing Automation into ….

Posted: Mon, 24 Apr 2023 16:01:06 GMT [source]

The expectation that staff will be able to guess what to do and that processes will naturally fall into place is an error. A process document streamlines resource allocation by organizing information into clear steps and connecting them with the resources needed. Whether you create an in-depth process flow or stick to a shared outline, documenting information right away can prevent work from getting derailed by issues in the long run. You can determine outputs by looking at your initial project objectives and selecting specific, measurable indicators. For example, if your objective is to spend less time on busywork, one of your outputs might be to automate task reminders. In that same example, your input might be to implement a work management tool.